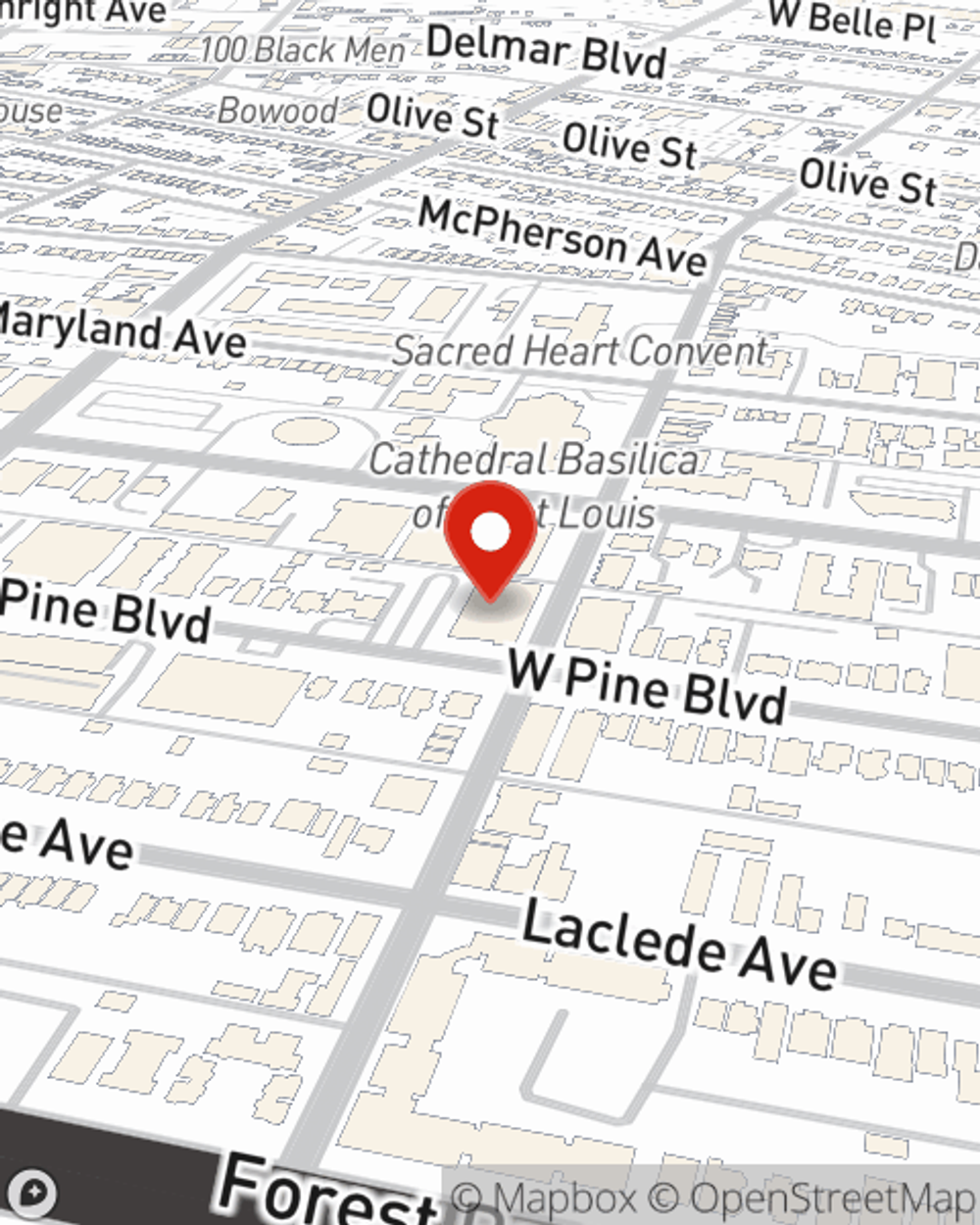

Life Insurance in and around St. Louis

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Central West End

- Steelville, MO

- Ballwin, MO

- St. James, MO

- Sullivan, MO

- Tower Grove

- Clayton

- Brentwood

- Ladue

- Creve Coeur

- Chesterfield

- U City

- Wentzville

- Catawissa

- Innsbrook

- CWE

Your Life Insurance Search Is Over

There's a common misconception that you should wait until you're older to get Life insurance, but even if you are young and a recent college graduate, now could be the right time to start learning about Life insurance.

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Why St. Louis Chooses State Farm

Coverage from State Farm helps you rest easy knowing your loved ones will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the high costs of financially supporting children, life insurance is an extreme necessity for young families. Even if you're a stay-at-home parent, the costs of replacing domestic responsibilities or before and after school care can be a great burden. For those who haven't had children, you may have a partner who is unable to work or be financially responsible to business partners.

If you're a person, life insurance is for you. Agent Wil Seyer would love to help you discover the variety of coverage options that State Farm offers and help you get a policy that works for you and your children. Reach out to Wil Seyer's office to get started.

Have More Questions About Life Insurance?

Call Wil at (314) 645-7000 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.